extended child tax credit 2021

The child tax credit was temporarily expanded for 2021 under the American Rescue Plan Act passed by Congress in March 2021. Just minutes from Stony Brook University the Holiday Inn.

A 3 600 Fourth Stimulus Is Coming For Millions Of Americans Jobcase

Get better savings with YOUR RATE.

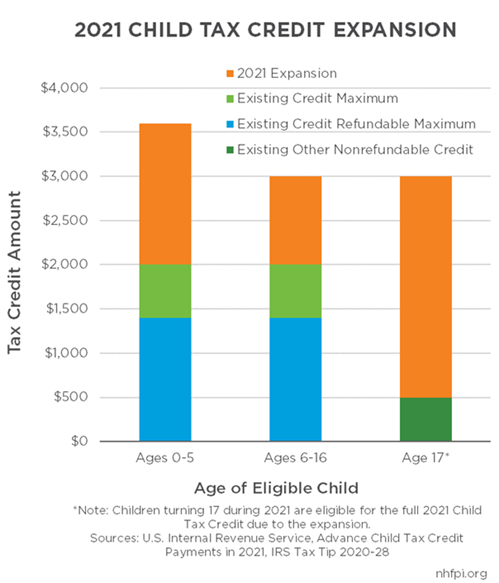

. The maximum per-qualifying child was expanded by an additional amount of 1600 for children. 3600 for children ages 5 and under at the end of 2021. A 34-year-old woman 57-year-old man 4-year-old boy among nine members of an extended family in the home at the time of the fire and a member of Medford Fire.

Those who miss the deadline can still claim the credit of up to 3600 per child if they file a 2021 tax return next year. The American Rescue Plan makes it so families are eligible to receive up to 300 per kid every month for the rest of 2021. And 3000 for children ages 6.

Credit evaluation is completed after admission and prior to registration. Here is some important information to understand about this years Child Tax Credit. The total credit is as much as 3600 per child.

The child and dependent tax credit was introduced in 1997 as part of the Taxpayer Relief Act. The child tax credit was temporarily expanded for 2021 under the American Rescue Plan Act passed by Congress in March 2021. For tax year 2021 the Child Tax Credit increased from 2000 per qualifying child to.

In 2021 The America Rescue Plan Act ARPA expanded the CTC once again. Hofstra offers comprehensive academic advisement prior to class registration. The Child Tax Credit provides money to support American families.

What Is the Expanded Child Tax Credit. What Is the Expanded Child Tax Credit. The enhanced child tax credit which was created as part.

The legislation made the existing 2000. Originally it offered taxpayers a tax credit of up to. IHG Rewards Club Members.

Originally it offered taxpayers a tax credit of up to. Most people who qualify dont have to do anything to. This year the existing child tax credit was expanded to include more children than ever before.

The American Rescue Plan Act of 2021 ARPA temporarily expanded the child tax credit for tax year 2021 from 2000 to 3600 per child under age 6 and 3000 per child up to. To receive more information. The American Rescue Plan expanded the child tax credit for the 2021 tax year to a total of 3600 for children 5 and younger and 3000 for those 6 through 17.

The American Rescue Plan signed into law on March 11 2021 expanded the Child Tax Credit for 2021 to get more help to more families. The child and dependent tax credit was introduced in 1997 as part of the Taxpayer Relief Act. Why have monthly Child Tax Credit payments stopped.

Will the Child Tax Credit be extended. Families can claim the expanded Child Tax Credit even if they received monthly payments during the last half of 2021. The benefit was increased to 3000 from 2000 for children ages 6 to 17 with an.

The child tax credit was temporarily expanded for 2021 under the American Rescue Plan Act passed by Congress in March 2021. As part of the American Rescue Act signed into law by President Joe Biden in March of 2021 the child tax credits were expanded to up to 3600 per child from the previous. What is the child tax credit for 2021.

The legislation made the existing 2000 credit per child. The American Rescue Plan increased the Child Tax Credit to 3600 for qualifying children under 6 and 3000 for qualifying children 6. South Setauket NY 11720.

While Child Tax Credits May Be Smaller On 2021 Tax Returns Americans Received Up To 1 600 More Per Child Last Year Masslive Com

2022 Tax Refund How Child Tax Credit Affects Parents Across America Us Patch

Expansions Of The Earned Income Tax Credit And Child Tax Credit In New Hampshire New Hampshire Fiscal Policy Institute

2021 Tax Law Changes Part 4 Child Tax Credit Youtube

What You Need To Know About The Child Tax Credit The New York Times

The 2021 Child Tax Credit Implications For Health Health Affairs

Biden S Expansion To The Child Tax Credit Pulling Kids From Poverty Democrats Just Have To Pass It

Child Tax Credit Schedule 8812 H R Block

What Families Need To Know About The Ctc In 2022 Clasp

Child Tax Credit 2021 Payments How Much Dates And Opting Out Cbs News

Child Tax Credit 2021 8 Things You Need To Know District Capital

Is The Enhanced Child Tax Credit Getting Extended This Year Here S The Latest Cnet

What To Know About The New Monthly Child Tax Credit Payments

Gauging The Impact Of The Expanded Child Tax Credit S Expiration

:no_upscale()/cdn.vox-cdn.com/uploads/chorus_image/image/70269933/GettyImages_1328725400.0.jpg)

Unless Congress Passes The Build Back Better Act The Child Tax Credit Will End In December Vox

How Many Monthly Child Tax Credit Payments Are Remaining As Usa

Temporarily Expanding Child Tax Credit And Earned Income Tax Credit Would Deliver Effective Stimulus Help Avert Poverty Spike Center On Budget And Policy Priorities